The success of retail Brokers lies, among others, in the ability to manage risk effectively. That allows them to increase profitability and safeguard the company from extreme market events. In a previous article, “A-Book vs B-Book Broker. The key differences between the two forex models”, we discussed the most significant differences between the A-Book and the B-Book models and the Hybrid Book model. This article will dive deeper into discussing various A/B-Book strategies for Retail Brokers they can use for effective risk management.

Official data reported by regulated Forex Brokers shows that, on average, 70% of traders lose invested funds; that number sometimes exceeds 90%. That’s why the B-Book model is typically considered the most profitable, as Brokers’ profits are often equal to their clients’ losses. But it’s not as simple as it sounds. Being the counterparty for all traders’ transactions and, thus, internalising the flow of their orders may also incur considerable losses for the brokerage when the market is favourable to traders.

That’s why we are going to discuss different strategies that Brokers can take on to manage risks effectively, having in mind the dynamic nature of the forex market. Hedging the biggest and best-performing clients and hedging on excess risk are some of the risk management strategies Brokers can use.

The balance between optimising profits and managing risks

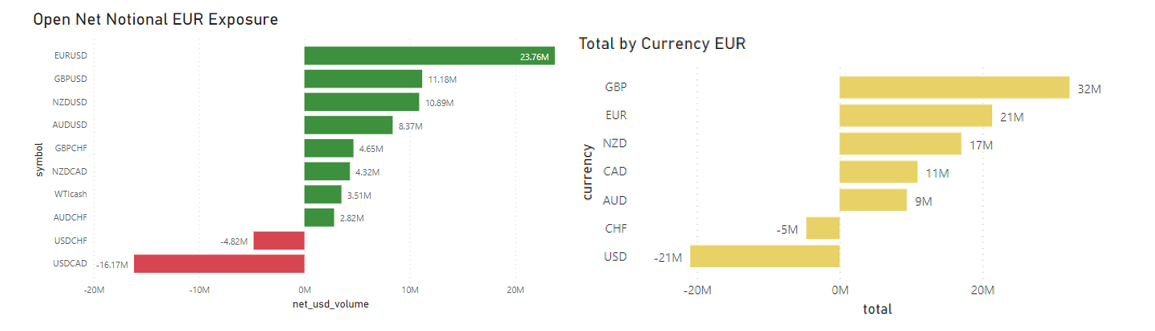

The dealing department of a retail Broker will need to balance between optimising profits and managing their client’s exposure (risk) to the market. This can be done by aggregating all client’s open positions by symbol or currency, with the volume depicted as Net Notional EUR (or USD) for standardisation and comparison. Using lot sizes as volume is wrong as you cannot compare instruments with different contract sizes:

Source: Microsoft PowerBI – own data

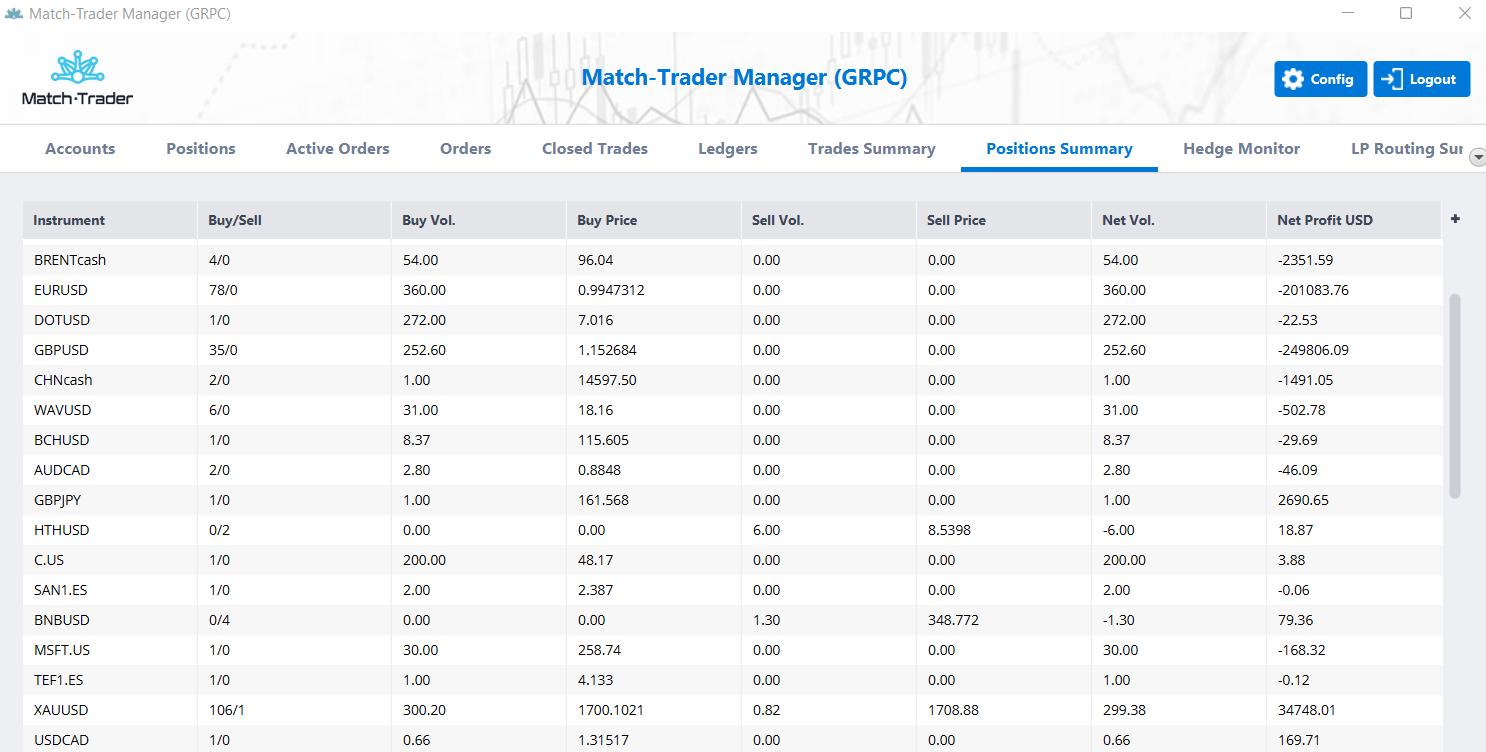

These data have to be extracted systematically, ideally automatically, in real-time. You can also view the exposure of the company in Match-Trader Manager under Summary or/and Exposure.

Source: Match-Trader Manager – demo

If a Broker uses Match-Trader, MT4 and MT5, these data need to be aggregated.

Optimising the profitability of a full B-Book model strategy will require the Broker to adopt a Hybrid or C-Book model, where it can choose to A-Book a portion of the open exposure and send it to the Liquidity Provider. An 80% B-Book and 20% A-Book rule can be applied as a rule of thumb depending on market conditions.

The dealing department will also have to manage the Broker’s risk on a hybrid model by trying to offset the over-exposure to a single financial instrument. For example, if all a Broker’s clients go in the same direction on the same financial instrument, that can be a considerable risk for a Broker if the trade turns sour.

Different A/B-Book strategies for Retail Brokers

There are various options a Broker can adopt to optimise their Book, which we will discuss below.

Firstly, we will explore Partial or Full Hedging of Profitable Clients.

Full or Partial Hedging of Profitable Clients

This is the most common Hybrid model where the dealing department will choose specific clients that have consistently profited in the past for their trades to be sent to the Liquidity Provider automatically. A careful analysis needs to happen of the trader’s accounts. They must also have enough trade history, at least for three months.

It can be done partially, meaning a percentage of the profitable client’s trades can be sent to the market. For example, at 50%, when the trader sends 1 lot, half of it, or 0.5 lots goes to the Liquidity Provider.

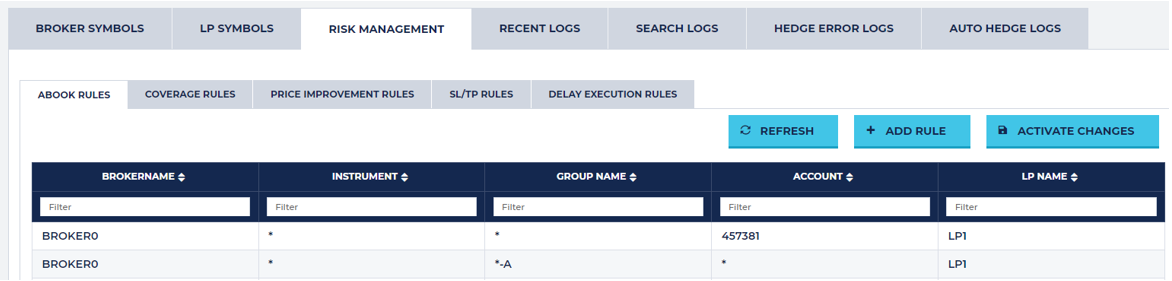

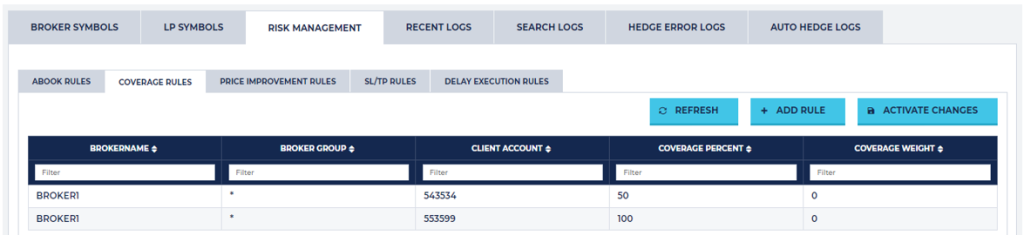

Hedging of Profitable clients must be done automatically through a Bridge. With Match-Trade Technologies’s Bridge, you can choose a single account or a group of clients to be sent to A-Book:

Source: Match-Trade’s Bridge

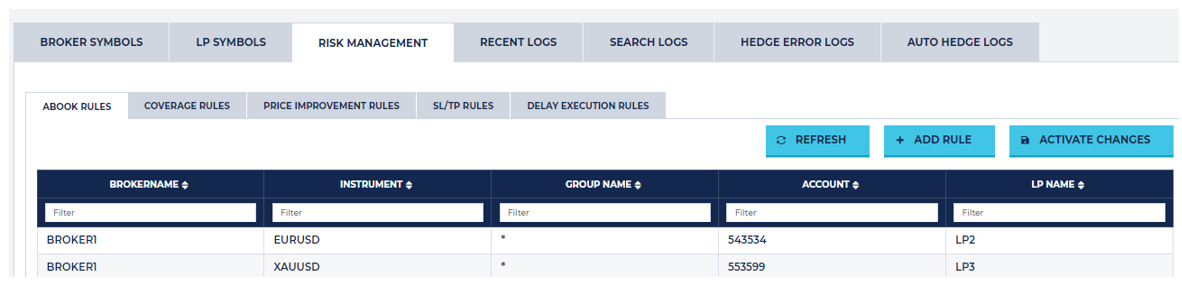

Also, there is the ability to add percentages for partial hedging:

Source: Match-Trade’s Bridge

Full or Partial Hedging of Profitable clients per Financial Instrument

Another Hybrid model strategy is to isolate the best performing Financial Instrument of a client and push trades to A-Book.

This also can be done partially, meaning a percentage of the profitable client’s trades on a specific Financial Instrument can be sent to the market. For example, at 50%, when the trader sends 1 lot of EURUSD, half of it or 0.5 lots goes to the Liquidity Provider.

Again, the Hedging of Profitable clients per Financial Instrument must be done automatically through a Bridge. With the Match-Trade Technologies’ Bridge, you can choose a single account or a group of clients but also specify the Financial Instrument to be sent to A-Book:

Source: Match-Trade’s Bridge

Also, there is the ability to add percentages for partial hedging:

Source: Match-Trade’s Bridge

Hedging on Excess Risk

B-Book Brokers often find themselves in a situation where most clients are trading a specific Financial Instrument in one direction (BUY or SELL). These are called one-sided exposures that create a fundamental risk to the business as they could bankrupt the Broker under extreme market conditions.

The Broker should decide on the volume limits in their exposure of what one-sided risk is willing to accept depending on their risk tolerance and company capitalisation.

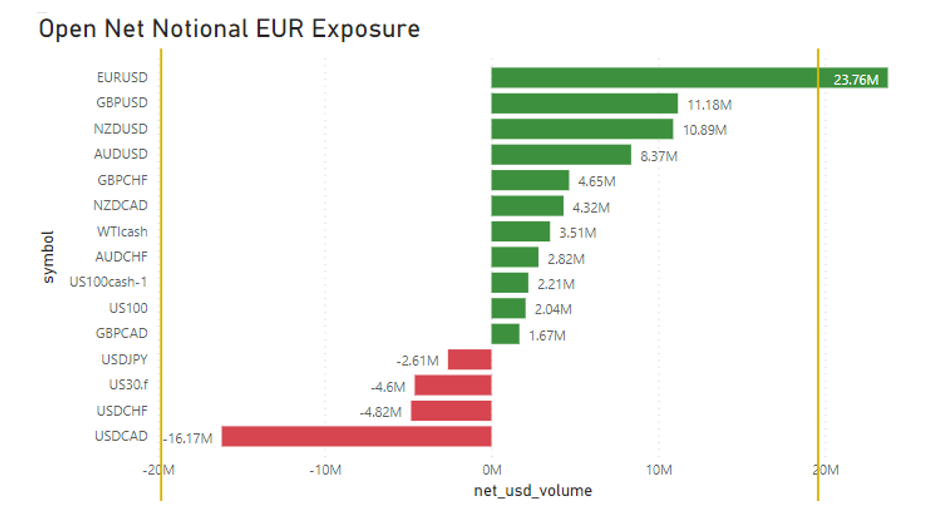

To illustrate this, a company could choose to A-Book anything above + or – (Long or Short) 20M limit as below:

Source: Microsoft PowerBI – own data

As you can see, EURUSD is above the Broker’s limit of 20M Net Notional EUR, so the Broker can go ahead and Buy 3.76M in the Open Market to reduce its B-Book Exposure. That will protect the Broker’s Book from adverse movements that will hurt the company’s profitability.

There are many more strategies to manage the risk of a Broker’s Book and optimise their profitability. We are happy to answer any questions you have on this subject. Please contact us for further information on our products and services that can help you run a successful brokerage.