Few instruments hold as much significance in Dubai as gold (XAUUSD), often called the “king of tradable instruments” in this vibrant financial hub. The trading landscape in Dubai is unique and shaped by both local and global factors, and first-hand observations reveal a distinctive trading behaviour here compared to other markets worldwide.

Growing Demand for Gold Liquidity in Dubai

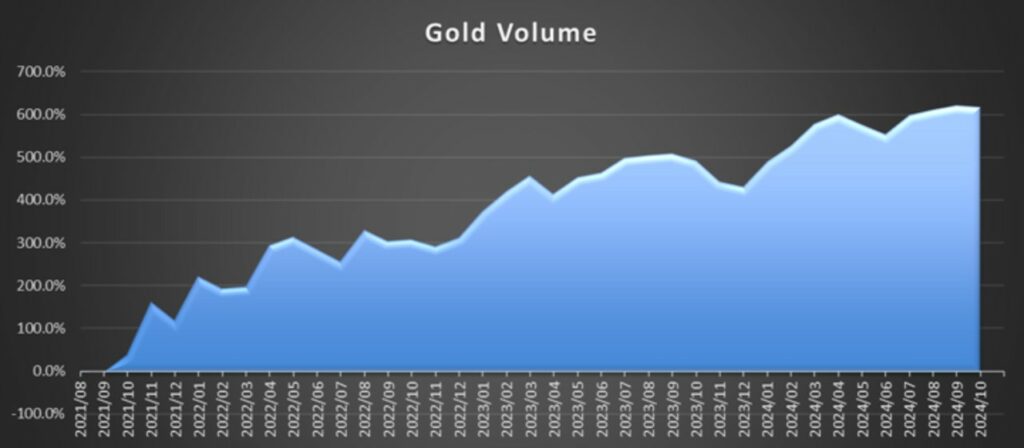

Over the past year, our liquidity flow in Dubai, especially in gold trading, has surged dramatically. We’ve recorded a 300% increase in gold trade flow from 2023 to 2024, reflecting Dubai’s expanding appetite for this precious metal and underscoring its importance to brokers and liquidity providers alike.

Gold’s price range last year sat between $1,812 and $2,142. However, as of 2024, we’re seeing prices as high as $2,700—marking a bullish trend with substantial yearly growth. This price momentum is crucial for brokers and liquidity providers, as it brings about high-volume trading that demands robust risk management and skilled dealing teams to turn this demand into an asset rather than a liability.

Why Gold Is Dominant in Dubai

Dubai has long been a preferred market for physical gold trading, attracting investors who wish to hedge against price fluctuations. This intrinsic need to hold gold within portfolios has strengthened gold’s presence in Dubai, making it a cornerstone for both retail and institutional investors.

In addition, global geopolitical tensions continue to drive gold’s safe-haven appeal, pushing its prices to record highs. As reported by Reuters, gold recently hit an all-time high in October, a trend that traders and investors closely watch as part of their portfolio diversification strategies.

The Need for Strong Risk Management Amid Challenges

For brokers and liquidity providers operating in Dubai’s gold-heavy market, opportunities often come with significant challenges. Rising gold demand has exposed certain vulnerabilities, including low Net Open Position (NOP) limits, that have forced brokers who previously internalised trades to start hedging flow with liquidity providers. Even liquidity providers (LPs) have had to reassess their NOP limits, sometimes passing flows to other LPs to maintain balance.

Conditions in this market highlight the need for liquidity providers with high NOPs, competitive spreads as low as 10 cents, and leverage capabilities that can accommodate the market’s demands. Furthermore, with increased trading volumes, there’s been a rise in sophisticated abuse tactics that require a vigilant risk and dealing team to detect and counter effectively.

The Dubai Market: A Promising Yet Demanding Landscape

Dubai is solidifying its position as a premier financial hub for the Contract for Difference (CFD) industry. New brokers and providers enter the market daily, fueling its growth and underscoring its potential. Yet, this market is not for the faint of heart—operating successfully requires a resilient risk management team, adaptability, and deep market knowledge.

With gold as one of the top traded instruments in Dubai, coupled with shifting geopolitical conditions, understanding the trends brokers prioritise in a liquidity provider is essential. They seek providers who can support their hedging needs while delivering the conditions required to excel in this dynamic market.

Partnering with a liquidity provider that goes beyond a standard “one-size-fits-all” offering—one that’s adaptive to brokers’ needs and market conditions—is the key to thriving in Dubai’s gold-heavy market.