Latency arbitrage is a strategy used by HFTs that leverages slight delays in the transmission of market data between different exchanges or exchanges and traders’ systems. It poses a significant challenge to CFD Brokers because it impacts market fairness and the integrity of trading activities. In this article, we are going to look at different types of latency arbitrage and the advanced features used by HFTs to employ them. We will also advise on the measures CFD Brokers can take to combat these harmful practices.

Types of Latency Arbitrage Strategies:

Classic Latency Arbitrage (One-Leg Arbitrage)

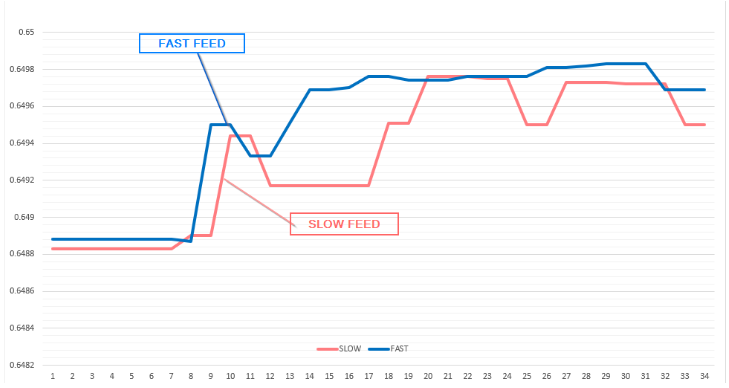

When a Broker’s server executing trades is slower and lags behind in updating quotes by leveraging market data feeds from a faster source, we are dealing with classic latency arbitrage. In this strategy, the trader uses the Broker feed to foresee the price change. By exploiting this time gap, they gain a risk-free advantage.

Lock Latency Arbitrage (Two-Leg Lock Arbitrage)

This strategy is the same as the Classic Latency Arbitrage, but the trader opens offsetting positions on two different accounts or Brokers. By locking in their positions, they can control the duration and exposure of the trade. This strategy is difficult to detect since it looks like two independent trades balancing each other.

Spread Latency Arbitrage (Multi-Leg Spread Arbitrage)

This latency arbitrage strategy takes advantage of price discrepancies for the same instrument across diverse Brokers. Traders use algorithms to identify such discrepancies in real-time and execute trades that capitalise on the spread between the different prices. These differences usually exist when Brokers skew the price on one side, which creates an arbitrage opportunity.

Hedge Latency Arbitrage (Two-Leg Simple Hedge)

In this latency arbitrage approach, traders use fast data providers to open positions and then slower Brokers to hedge them. This masks the arbitrage activity as it makes these trades appear as standard trades between two Brokers.

Advanced Features Used in Latency Arbitrage

To make their latency arbitrage strategies even more beneficial, today’s traders use cutting-edge technologies.

- direct market access: to reduce delays, HFTs connect directly to exchanges, thus bypassing traditional trading platforms. However, participating in an exchange with direct market access comes with exchange fees.

- co-location: traders using latency arbitrage strategies often invest in co-locating their trading servers in data centres close to exchange servers to minimise communication delays.

- execution speed: traders using the FIX protocol instead of traditional trading platforms significantly improve their execution speed, thus outpacing standard trading operations.

- quote analysis software: traders performing the latency arbitrage may also use advanced algorithms analysing tick quotes to identify the optimal timing for trade execution for the trade opening and closing.

Recommendations for CFD Brokers

Latency arbitrage strategies reduce market fairness and the integrity of trading activities, so CFD Brokers should implement adequate measures to reduce their impact. Here are our recommendations:

- checking trade sources: identifying the IP address, internet service provider, and country of your clients’ trades is a good starting point for detecting possible latency arbitrage activities. HFTs using such strategies typically employ VPNs close to popular data centres to reduce the ping delay.

- enhanced price and trade monitoring: to detect latency arbitrage, Brokers may employ price and trade monitoring technologies capable of identifying complex trading patterns and comparing pricing with other reliable sources.

- infrastructure upgrades: reducing data transmission delays through high-speed data feeds, co-location services, and direct market access technologies can help level the playing field.

- order execution policies review: to prevent giving priority to the fastest orders, Brokers may modify how orders are queued and executed.

- slippage and price improvement policies: implementing policies that ensure trades are executed at the best available prices regardless of speed can mitigate the impact of latency arbitrage.

- a vigilant Dealing team: usually, identifying patterns in trades or prices requires an experienced Dealing department. Like in a mosaic, CFD Brokers need to put all the pieces together to find possible Latency Arbitrage traders.

- regulatory compliance: Brokers must keep up with and adhere to regulatory measures designed to prevent market abuse.

Final Thoughts on Latency Arbitrage

By understanding the detailed workings of latency arbitrage strategies and the technologies that enable them, CFD Brokers can better prepare their systems to detect and deter such practices. In our opinion, it’s all about creating a fair trading environment where technology is used to enhance the trading experience for all market participants equitably.

In the next part of this series, we are going to examine some more trading strategies relating to latency arbitrage. Follow us on LinkedIn to be the first to read it!