This year has posed substantial challenges for brokers, necessitating swift adaptation from liquidity providers in response to emerging issues. LPs find themselves constantly balancing competing priorities – ensuring client satisfaction, optimizing risk management, and preserving their competitive market position.

Long-Standing Problems Challenging Brokers

Traders’ growing access to advanced technology has coincided with the emergence of complex toxic trading flows. This includes latency arbitrage and gold-market manipulation, with a notable concentration in certain Asian markets. While these challenges are widely recognized across the industry, there are no simple, scalable solutions to address them.

Match-Prime’s Answer to Market Demands

On the one hand, liquidity providers must offer highly competitive institutional conditions, while on the other, brokers frequently rely on LPs to manage their most challenging flow. This naturally leads to greater exposure to toxic trading behavior. Rising to this challenge, Match-Prime has developed an advanced, in-house Risk Management System (RMS), HawkEye, that precisely identifies and mitigates harmful flows in real time without disrupting standard trading activity.

How HawkEye RMS Tackles the Industry’s Toughest Challenges

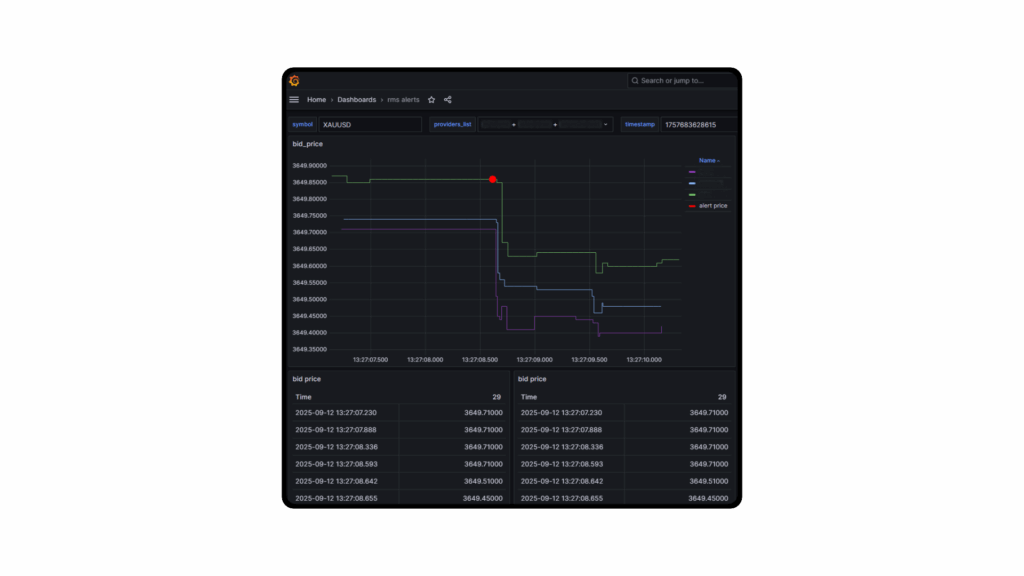

Gold Abuse/Market Manipulation

Match-Prime’s RMS detects specific behavioral patterns characteristic of gold-market manipulation. Once triggered, the system instantly reroutes the affected flow to a specialized XAUUSD liquidity pool designed to absorb such activity under competitive conditions. This strategic approach safeguards broker profitability and maintains tight spreads while ensuring uninterrupted trading experiences for clients.

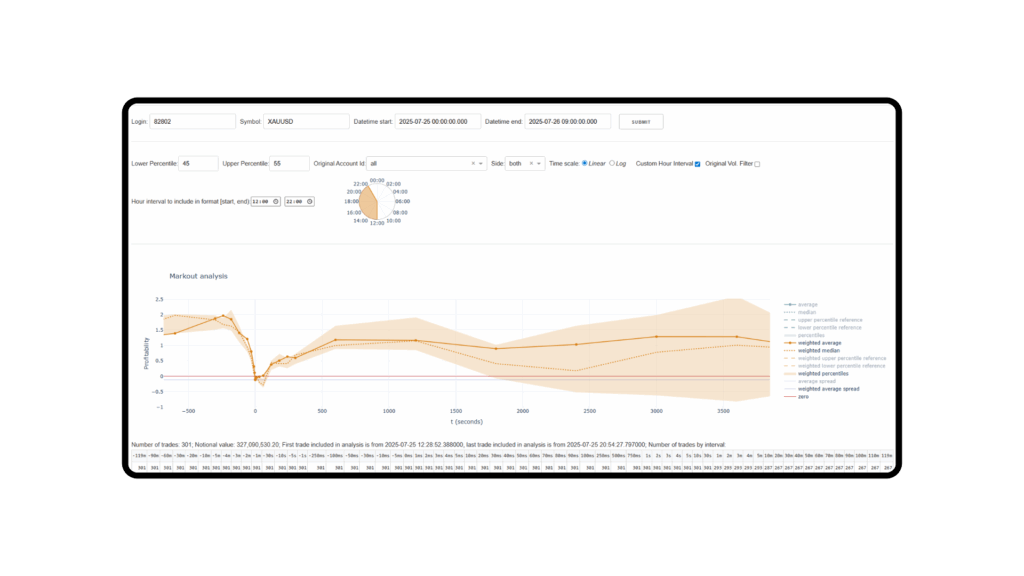

Latency Arbitrage

HawkEye continuously performs real-time markout calculations and spread coverage analysis over defined time frames to identify latency arbitrage. Once detected, the problematic flow is automatically shifted to dedicated liquidity pools, preserving optimal trading conditions for legitimate clients.

Why Match-Prime’s Risk Solutions Create Value for Brokers

Fast Detection

Numerous startups and mid-sized brokers operate without the experience or tools to identify harmful trading patterns. Left undetected, these patterns can lead to substantial financial losses and even threaten business continuity. Match-Prime’s solution eliminates the need for brokers to independently assess flow toxicity.

Quick Reaction

Our RMS analyzes the flow, detecting and classifying toxic behavior early and rerouting it instantly – based on FIX tags – to specialized liquidity pools, ensuring:

- Uninterrupted trading for other clients

- Preserved execution quality

- Protected profitability

Individual Approach

Unlike LPs who respond by employing blanket measures such as account blocking or condition degradation for all trades, we implement a targeted approach. Our strategic framework incorporates the development of dedicated liquidity pools tailored to diverse risk profiles. This infrastructure enables brokers to maintain profitable relationships across their entire client spectrum – including those with challenging flows – without necessitating punitive interventions.

Match-Prime: Liquidity Backed by Technology

For today’s brokers, the smartest move is partnering with a liquidity provider that goes beyond competitive pricing to actively safeguard your business through cutting-edge proprietary technology.

Match-Prime isn’t your typical liquidity provider – we’re tech-driven at our core. Backed by our sister company, Match-Trade Technologies, with more than 120 developers on-site, we deliver unparalleled protection and technological excellence.

We use our in-house-developed platform, Match-Trader, to provide margin accounts, liquidity aggregation, and FIX connectivity to a broad broker base around the world, without any third-party tech dependencies.

When partnering with Match-Prime, you gain access to an established liquidity provider with proprietary defensive technologies specifically designed to:

- Identify and counteract toxic flows

- Safeguard and enhance your profitability

- Deliver seamless, high-quality trading experiences for your clients