In the previous article, “A/B-Book strategies for Retail Brokers – Expert Opinion”, we discussed the most common hedging strategies for retail Brokers that they can utilise to optimise their profitability and reduce risk. Today, we prepared part 2 with additional ones.

As mentioned in the previous article, optimising the profitability of a full B-Book model will require the Broker to adopt a Hybrid or C-Book model, where the Broker can choose to A-Book a portion of the open exposure and send it to the Liquidity Provider. An 80% B-Book and 20% A-Book rule can be applied as a rule of thumb depending on market conditions.

Hedging strategies for retail Brokers

Full or Partial Hedging of High-Risk Clients

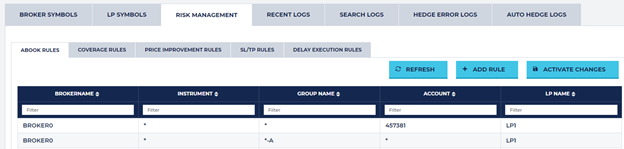

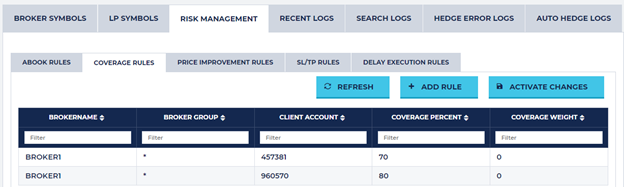

This strategy involves sending clients that make the most volume in a retail brokerage to A-Book. In all brokerages, there is a group of clients who makes most of the volume and, therefore, can be considered High-Risk clients. No matter their profitability, these clients can damage the brokerage’s profitability in one day. On the Match-Trade Bridge, individual clients (1st line) or groups (2nd Line) can be set up to be sent to A-Book.

It might not be ideal to send 100% of the volume to A-Book as this might hurt the Broker’s profitability. In this case, there is the ability to add percentages for partial hedging, which can be set up depending on the client’s past P/L performance:

Hedging of Volatile Financial Instruments

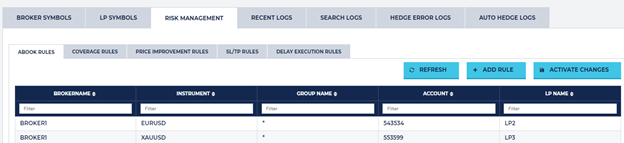

An alternative Hybrid model strategy is to segregate the most volatile financial instruments and send them to A-Book to protect the brokerage from sudden market moves.

Some of the most volatile financial instruments are:

· From Forex Majors: the GBP/USD and AUD/USD.

· From Forex Minors: the currency pairs associated with the Japanese Yen like GBP/JPY, AUD/JPY and NZD/JPY.

· From the Forex emerging economies: USD/ZAR, USD/TRY, USD/MXN

· From the commodities: Gold (XAU/USD) is very volatile.

This strategy can also be done partially, meaning a percentage of the client’s trades on a specific volatile financial instrument can be sent to the market. For example, at 50%, when the trader sends one lot of EURUSD, half of it or 0.5 lots, goes to the Liquidity Provider.

Again, the Hedging of Profitable clients per Financial Instrument must be done automatically through a Bridge. With the Match-Trade Bridge, you can choose a single account or a group of clients but also specify the financial instrument to be sent to A-Book:

Hedging on Excess Risk per Currency

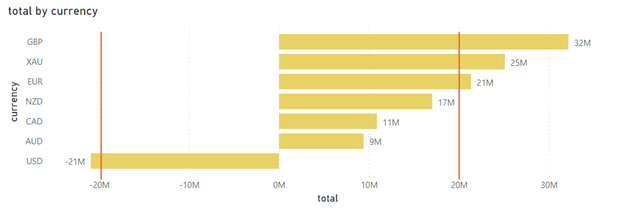

In the first part of this article, we discussed that Brokers could hedge the excess risk of a specific symbol that is overexposed in their Books. A variation of this is to look at the aggregated open exposure, but instead of per Symbol, do it per Currency. This will help the Dealer/Risk Manager to understand the aggregated risk he has on his Books per Currency.

Depending on their risk tolerance and company capitalisation, Brokers should decide on volume limits in their exposure of what one-sided risk they are willing to accept. To illustrate this, a company could choose to A-Book anything above + or – (Long or Short) 20M limits as below:

For example, GBP is above the Broker’s limit of 20M Net Notional EUR, so he can Buy 12M in the Open Market (A-Book) to reduce the B-Book Exposure. That will protect the Broker’s Book from sudden movements that could hurt the company’s profitability.

We are happy to answer any questions you have on this subject. Also, contact us if you need further information about our products and services.