Latency arbitrage techniques continue to evolve, becoming accessible to an ever broader retail audience. In the second part of this series, we are uncovering additional strategies utilised by high-frequency traders and outlining proactive measures that Brokers can adopt to counter and mitigate the detrimental effects of these practices on market equilibrium and trading integrity.

As explained in the first part of this series, latency arbitrage exploits minuscule delays in data transmission across trading platforms, which offers a potential risk-free advantage to traders but raises concerns about market integrity and fairness for CFD Brokers.

In the previous blog post, we described the most common arbitrage strategies. This time, we will discuss more sophisticated methods.

Advanced Latency Arbitrage Strategies

News Price Arbitrage

This latency arbitrage method is the same as the Classic Hedge mentioned in Part 1, but the trader applies it at the times when high impact news hits. Their Broker’s server executing trades is slower and lags behind in updating quotes by leveraging market data feeds from a faster source. This is when they can see the biggest differences in prices, and so take the most advantage of the latency arbitrage.

Advanced Masking Techniques to Lock Profit

Traders have devised sophisticated masking tactics to capture potential profits during latency arbitrage opportunities. It involves software creating a simulated opening or closing through the use of pending orders such as Stop Loss, Trailing Stop, and Take Profit. They can also combine different accounts or/and broker hedging positions. The goal of this technique is to mask their trades to look normal.

Triangular Arbitrage

The Triangular Arbitrage strategy involves exploiting inconsistencies among three currency pairs to profit from the exchange rate discrepancies between them. By leveraging the mismatched rates between currencies A/B, B/C, and C/A, exploiters aim to conduct rapid, sequential trades to capitalise on the imbalance.

Traders may also combine this strategy with the Classic Latency Arbitrage by scanning for price latency inefficiencies from multiple Brokers and acting in parallel. By exploiting this time gap, they gain a risk-free advantage.

Technology Supporting Latency Arbitrage

Traders engaged in latency arbitrage practices leverage sophisticated technologies to enhance their strategies. Some of them include:

- direct market access: high-frequency traders (HFTs) establish direct connections to stock exchanges, bypassing conventional trading platforms, to reduce time delays. This approach, however, incurs additional exchange fees

- co-location: to minimize communication lag, traders house their trading servers in data centers located near exchange servers.

- execution speed: some traders use the FIX protocol rather than traditional trading platforms to boost their execution speed, thereby surpassing regular trading operations

- quote analysis software: for optimal trade execution timing, both at the opening and closing of trades, traders in latency arbitrage employ sophisticated algorithms that scrutinize tick quotes.

Protection against Latency Arbitrage

Latency arbitrage practices undermine the fairness and integrity of the trading market. Therefore, it is crucial for CFD Brokers to take appropriate steps to mitigate their effects. We recommend the following protection measures:

- verifying trade sources: checking the IP address, internet service provider, and country origin of clients’ trades is an effective first step to spot potential latency arbitrage because traders employing such methods often use VPNs near key data centers

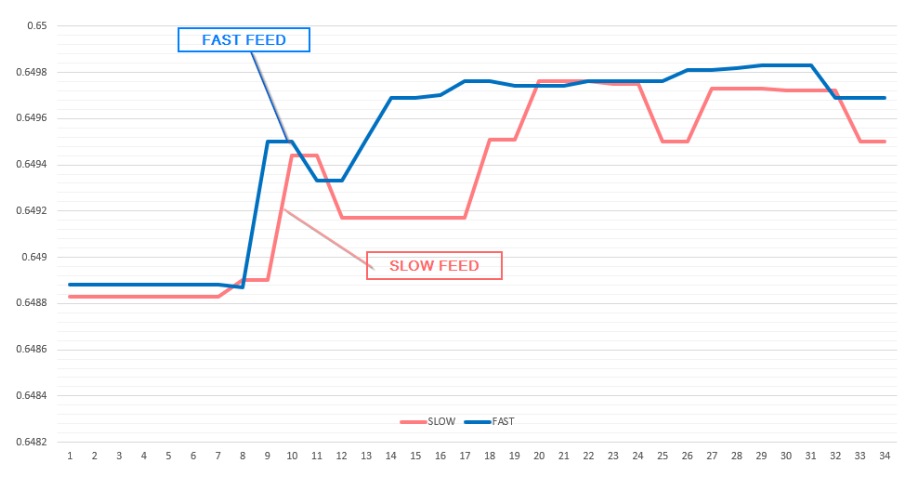

- monitoring prices and trades: Brokers may use sophisticated monitoring systems designed to recognize complex trading patterns and cross-reference prices with other trustworthy sources

- upgrading infrastructure: enhancing data transmission speeds through high-speed data connections, co-location services, and advanced direct market access technologies can help create a more equitable trading environment

- revising order execution policies: Brokers might consider changing how they queue and execute orders to avoid favoring the quickest orders

- creating policies for slippage and price improvement: establishing guidelines that ensure trades are executed at the best available prices, regardless of speed, can lessen the effects of latency arbitrage

- building a vigilant dealing team: detecting unusual trade or price patterns often requires a skilled Dealing department as Brokers need to piece together various indicators to identify possible latency arbitrage traders

- adhering to regulations: Brokers must continuously comply with regulatory standards aimed at preventing market exploitation.

Final Thoughts on Latency Arbitrage

Latency arbitrage strategies and the technology used to employ it still evolve, so our list is likely to get longer in near future. We are keeping an eye on emerging market abuse techniques, so make use to follow us on LinkedIn to get updates on our new articles.