The order book is a critical element of financial markets, providing a transparent view of supply and demand for a particular asset organised by price level. In organised exchanges, it is formed through the collective actions of buyers and sellers who place orders to buy or sell an asset at a specific price. This article, another part of Match-Prime’s Market Basics cycle, aims to delve into the role of FX Liquidity Providers in shaping the order book and its significance in financial markets.

In the Forex industry, Liquidity Providers are also called market makers because they “make” the market. This essentially means that an FX Liquidity Provider can create their order book for any financial instrument based on their internal supply, demand, and risk tolerance for a specific financial instrument.

The vast majority of Forex pairs, and almost all other Contracts of Difference (CFDs), are Over the Counter (OTC) financial instruments. As a result, the order book can be constructed to display the current supply and demand of a specific FX Liquidity Provider.

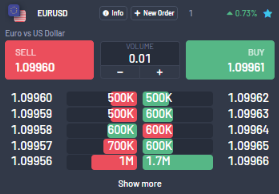

The order book is organised by lines (or “layers”) that show traders how much volume they can buy or sell at a specific price.

The Sell-Side (Bid price) shows at which price and at which volume traders can Sell. Conversely, the Buy-Side (Ask price) shows at which price and at which volume traders can Buy.

The first line of the order book, also called the Top of Book (TOB), has the lowest spread, and it represents the highest bid and the lowest ask at that time.

The lower you go in the order book, the more the volume and spread increase. The reason for this is that together with the volume increases the risk for the FX Liquidity Provider.

Some FX Liquidity Providers choose to have order book layers fixed at specific volumes, while others have a variable volume per line. When a trader intends to sell or buy a substantial volume, they must move beyond the Top of Book, accepting different prices for each volume available.

To illustrate this: if, for example, the Top of Book is 5 lots and the trader wants to Sell EURUSD, in one click, 7 lots, they will be executed 5 lots on the Top of Book line and 2 lots on the second line. This means that they will be executed at two different prices. FX Liquidity Providers usually show one price as a Volume Weighted Average Price (VWAP).

The calculation could be demonstrated as follows:

- We multiply the lot size with the price associated:

- 5 lots at 1.09960 (5 * 1.09960 = 5.498 )

- 2 lots at 1.09959 (2 * 1.09959 = 2.19918)

- We sum the multiplication results and divide them by the total lot size to find the VWAP price:

- 7.69718 / 7 = 1.099597

This will be the VWAP that the trade got executed at in the example above.

In summary, the order book serves as an essential aspect of financial markets, delivering a transparent and systematically organized depiction of asset supply and demand across different price points. FX Liquidity Providers hold a pivotal position in the formation of the order book, which is instrumental in grasping market dynamics and executing trades. A thorough understanding of the order book’s structure enables traders to gain valuable insights into risk management strategies employed by FX Liquidity Providers, as well as the interplay between price and volume levels. Equipped with this knowledge, traders can navigate the financial markets more effectively and seize opportunities as they emerge.